https://sputnikglobe.com/20240811/fiat-currency-apocalypse-approaches-as-central-banks-dump-dollars-for-gold-1119725075.html

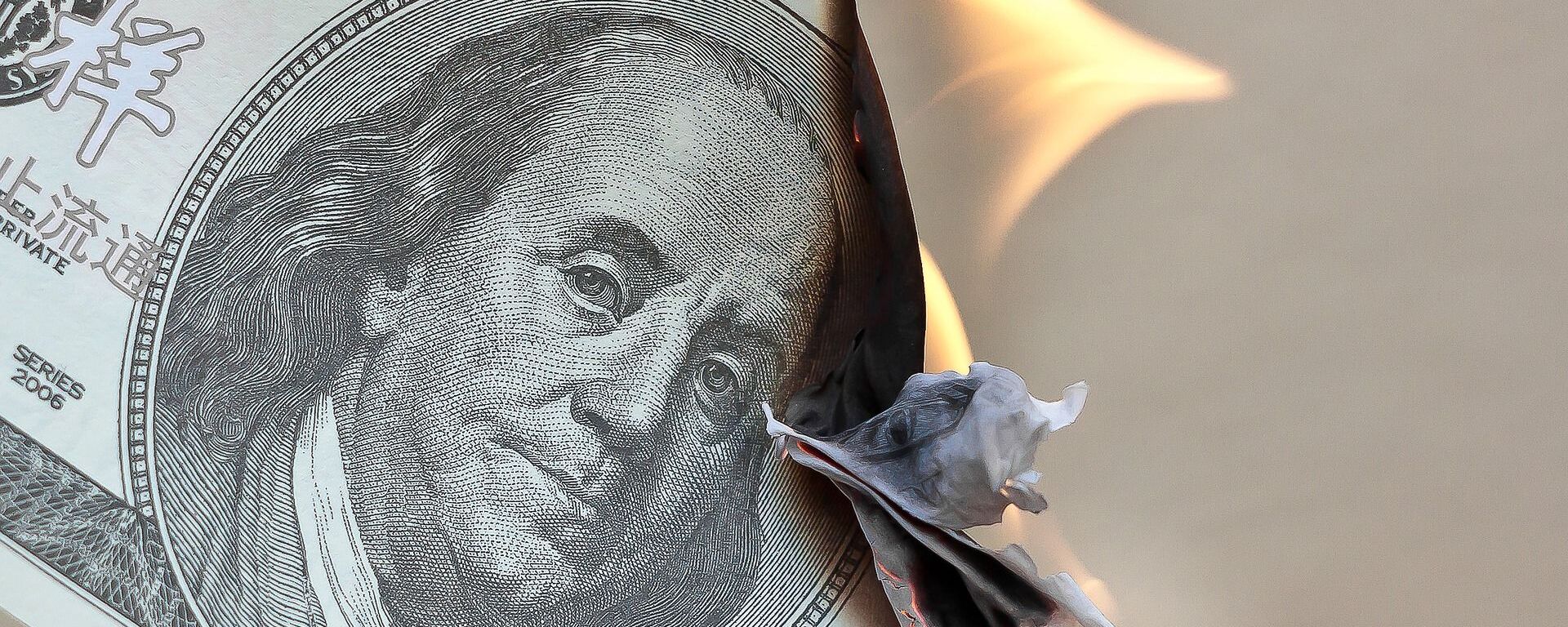

Fiat Currency Apocalypse Approaches as Central Banks Dump Dollars for Gold

Fiat Currency Apocalypse Approaches as Central Banks Dump Dollars for Gold

Sputnik International

US Federal Reserve Chairman Jerome Powell repeated his long-running warning about US debt levels being “unsustainable” at a European forum on central banking last month. In February, El Salvadoran President Nayib Bukele warned that the Fed strategy of “printing money out of thin air” amounts to “a bubble that will inevitably burst.”

2024-08-11T15:13+0000

2024-08-11T15:13+0000

2024-08-11T15:13+0000

economy

jerome powell

nayib bukele

donald trump

business

china

russia

ukraine

us treasury

world gold council

https://cdn1.img.sputnikglobe.com/img/102218/65/1022186545_0:54:1024:630_1920x0_80_0_0_18f2c31728e8d7e2be5f6428b315c1f3.jpg

Central banks’ holdings of dollar-denominated assets have reached a historic low, driven by Washington’s attempts to lock resource-rich Russia out of the dollar-based global financial system, which has led developing countries to seek refuge in gold as an asset whose value and convertibility isn’t tied to the whims of any one nation and therefore cannot be as easily weaponized.IMF estimates from the spring cited by Japanese financial newspaper Nikkei in a recent report show that dollar and US Treasury-denominated foreign reserves have hit to 58.9 percent in 2024, down from about 70 percent two decades ago.Reserves denominated in China’s yuan have also dropped, from about three percent of total foreign reserve holdings in early 2022 to roughly 2 percent today, with Ukraine, Norway, Brazil, Switzerland and Israel leading the way in drawing down their yuan holdings.A World Gold Council survey published in June calculated that central banks’ purchase of the precious metal topped 1,037 tons in 2023 – the second-highest annual buy-up in history after purchases in 2022, which amounted to 1,082 tons.China has led the bullion buy-up, adding gold to its reserves for 18 consecutive months from November 2022 onward, increasing them by 16.3 percent, to about 2,264 tons total as of June.India has also rapidly stacked up its gold-denominated assets, which are currently worth $57.6 billion, or 30 percent more than they were during the same period in 2023. Delhi purchased some 19 tons of gold in the first quarter of 2024 alone, for a total of 841 tons. Apparently learning lessons from Venezuela, Russia and Libya’s sour experiences relating to the risks of storing central bank assets in foreign countries, India recently moved about 100 tons of its gold reserves from Britain back home to domestic vaults.Nikkei cites the ongoing conflicts in Ukraine and the Middle East, which show no signs of stopping anytime soon, and the “geopolitical risk” of a second Trump term as president and a potential escalation of US-China tensions as factors which are likely to drive central banks to continue dumping dollars and other fiat currencies and stacking up their gold holdings instead.»Not even those high taxes, higher than a lot of places in the world…are really funding the [US] government,» El Salvadoran President Nayib Bukele said at a forum in Washington in February.

https://sputnikglobe.com/20240629/investor-jim-rogers-russian-asset-seizure-by-the-west-undermines-trust-in-the-us-dollar-1119178278.html

https://sputnikglobe.com/20240622/debt-disaster-why-global-south-increasingly-sidelines-the-us-dollar-1119059080.html

https://sputnikglobe.com/20240625/eu-accelerates-de-dollarization-by-stealing-russian-money-1119126047.html

china

russia

ukraine

2024

News

en_EN

https://cdn1.img.sputnikglobe.com/img/102218/65/1022186545_57:0:968:683_1920x0_80_0_0_171ad1673f6991acc104cd9350f03eff.jpg

will gold replace the dollar, is gold a good asset, when is gold a good asset, is gold as good as dollar, is gold better than dollar

will gold replace the dollar, is gold a good asset, when is gold a good asset, is gold as good as dollar, is gold better than dollar

US Federal Reserve Chairman Jerome Powell repeated his long-running warning about US debt levels being “unsustainable” at a European forum on central banking last month. In February, El Salvadoran President Nayib Bukele warned that the Fed strategy of “printing money out of thin air” amounts to “a bubble that will inevitably burst.”

Central banks’ holdings of dollar-denominated assets have reached a historic low, driven by Washington’s attempts to lock resource-rich Russia out of the dollar-based global financial system, which has led developing countries to seek refuge in gold as an asset whose value and convertibility isn’t tied to the whims of any one nation and therefore cannot be as easily weaponized.

Reserves denominated in China’s yuan have also dropped, from about three percent of total foreign reserve holdings in early 2022 to roughly 2 percent today, with Ukraine, Norway, Brazil, Switzerland and Israel leading the way in drawing down their yuan holdings.

China has led the bullion buy-up, adding gold to its reserves for 18 consecutive months from November 2022 onward, increasing them by 16.3 percent, to about 2,264 tons total as of June.

Nikkei cites the ongoing conflicts in Ukraine and the Middle East, which show no signs of stopping anytime soon, and the “geopolitical risk” of a second Trump term as president and a potential escalation of US-China tensions as factors which are likely to drive central banks to continue dumping dollars and other fiat currencies and stacking up their gold holdings instead.

«Not even those high taxes, higher than a lot of places in the world…are really funding the [US] government,» El Salvadoran President Nayib Bukele said at a forum in Washington in February.

«So, who’s financing the government? Government is financed by Treasury bonds, paper. And who buys the Treasury bonds? Mostly the Fed. And how does the Fed buy them? By printing money. But what backing does the Fed have for that money being printed? The Treasury bonds themselves. So basically, you finance the government by printing money out of thin air. Paper backed with paper. A bubble that will inevitably burst. The situation is even worse than it seems because if most Americans and the rest of the world were to become aware of this farce, confidence in your currency would be lost,» Bukele warned.