https://sputnikglobe.com/20240131/gold-prices-surge-amid-economic-instability-strong-chinese-demand-1116516262.html

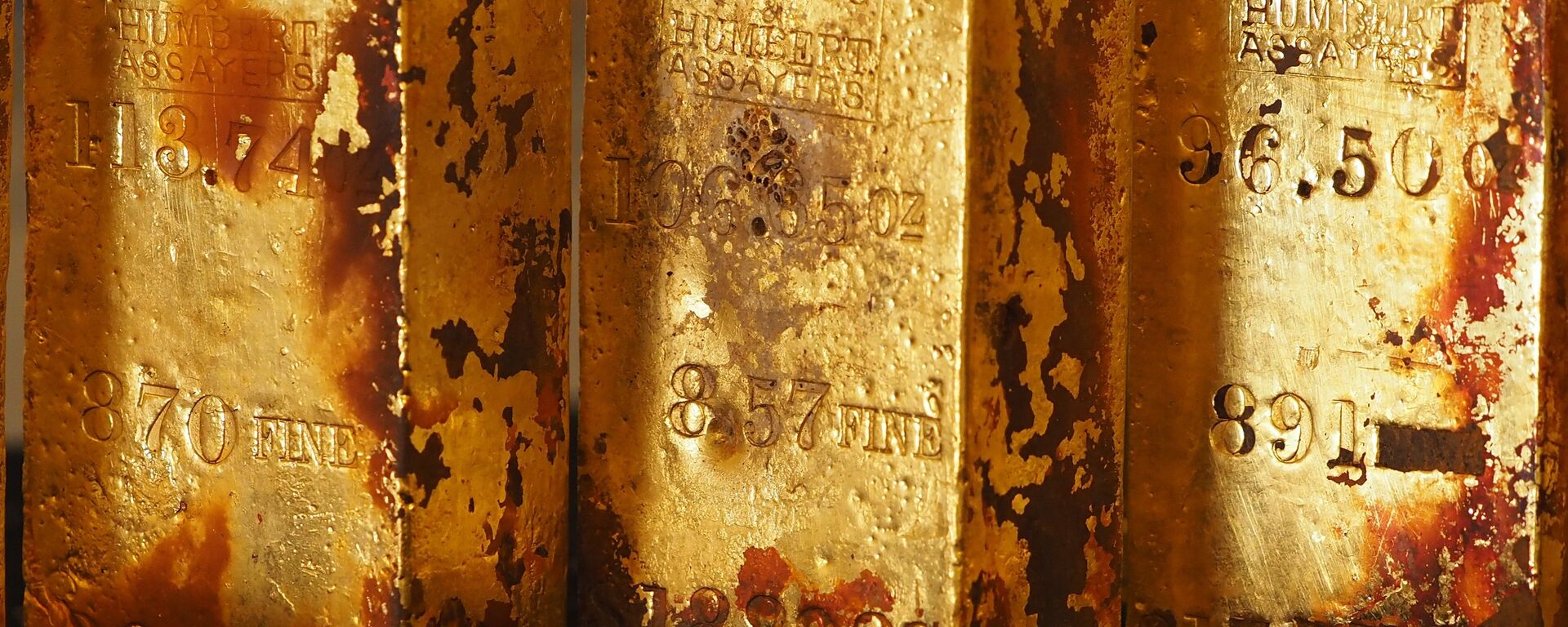

Gold Prices Surge Amid Economic Instability, Strong Chinese Demand

Gold Prices Surge Amid Economic Instability, Strong Chinese Demand

Gold’s price exceeds $2,000 per troy due to an upswing in investments from Chinese investors and households and last year’s surge in purchases by central banks worldwide.

2024-01-31T19:54+0000

2024-01-31T19:54+0000

2024-01-31T19:55+0000

world

business

imf

china

world gold council

financial times

/html/head/meta[@name=»og:title»]/@content

/html/head/meta[@name=»og:description»]/@content

https://cdn1.img.sputnikglobe.com/img/07e7/08/09/1112487926_0:131:2648:1621_1920x0_80_0_0_5a95dec92078fc8781f9502d85a4ea2b.jpg

Households and investors in China have been purchasing gold as a hedge from their market and property turmoil, propping up the price appreciation for the asset, the Financial Times reports.World Gold Council’s (WGC) 2023 quarterly report ranked China as the leading country worldwide for gold investments following the Asian giant’s post-COVID-19 poor-run on currency, equity, and property markets.The yellow metal’s price rose last year when central banks worldwide bolstered their gold holdings following warning signs of distrust over the US confiscation of about $300 billion of Russian assets and the country’s mounting debt profile above $34 trillion. Chinese demand for the precious metal helped its value surge last December, and the price per troy ounce has remained above $2,000.Chinese investors are steeped in an “ugliness contest” regarding where to invest their vast savings accumulated during the pandemic. «Gold exposure has become a necessity for Chinese portfolios as they continue to expect disinflation and income uncertainty,» Colin Hamilton, an analyst at BMO, told the Times.The 2023 WGC report showed that gold demand slumped by 5% to 4,448 tons, loosening after a strong 2022. However, after capturing nontransparent sources of buying the asset, like stock and over-the-counter flows, last year’s demand increased to 4,899 tons.Interest rate hikes last year, which helped increase bonds’ attractiveness compared to yellow metal, did not diminish the demand and price gains the metal recorded the previous year.The asset’s investment demand dipped to a 10-year low of 945 tons. Still, Chinese, Polish and Singaporean central bank purchases helped neutralize the poor investment demand, keeping net acquisitions higher than 1,000 tons. However, many financial institutions concealed their purchase volumes from the IMF, or opted for other state entities to buy the priced metal.

https://sputnikglobe.com/20230820/is-it-a-good-idea-to-invest-in-gold-1112742707.html

china

2024

Chimauchem Nwosu

https://cdn1.img.sputnikglobe.com/img/07e7/09/01/1113046371_0:99:1536:1635_100x100_80_0_0_9c5c627283eca931c39fe4852bbb301c.jpg

Chimauchem Nwosu

https://cdn1.img.sputnikglobe.com/img/07e7/09/01/1113046371_0:99:1536:1635_100x100_80_0_0_9c5c627283eca931c39fe4852bbb301c.jpg

News

en_EN

https://cdn1.img.sputnikglobe.com/img/07e7/08/09/1112487926_156:0:2492:1752_1920x0_80_0_0_0c3715eccee78886b8f574413e4280b4.jpg

Chimauchem Nwosu

https://cdn1.img.sputnikglobe.com/img/07e7/09/01/1113046371_0:99:1536:1635_100x100_80_0_0_9c5c627283eca931c39fe4852bbb301c.jpg

gold’s spot price, yellow metal, gold, price of gold, chinese gold investors, gold exposure

gold’s spot price, yellow metal, gold, price of gold, chinese gold investors, gold exposure

Amid global economic uncertainty, the price of gold has soared, driven by increased central bank holdings and strong Chinese demand as concerns over US asset seizures and rising debt influence the precious metal’s market.

Households and investors in China have been purchasing gold as a hedge from their market and property turmoil, propping up the price appreciation for the asset, the Financial Times reports.

Chinese investors are steeped in an “ugliness contest” regarding where to invest their vast savings accumulated during the pandemic. «Gold exposure has become a necessity for Chinese portfolios as they continue to expect disinflation and income uncertainty,» Colin Hamilton, an analyst at BMO, told the Times.

Interest rate hikes last year, which helped increase bonds’ attractiveness compared to yellow metal, did not diminish the demand and price gains the metal recorded the previous year.