Table of Contents

A crazed socialist who knows little about private sector employment because he never held a real job could be running New York City – which seems like the biggest sell signal imaginable if you’re one of those Gothamites who own “tax-free” municipal bonds issued by the Big Apple.

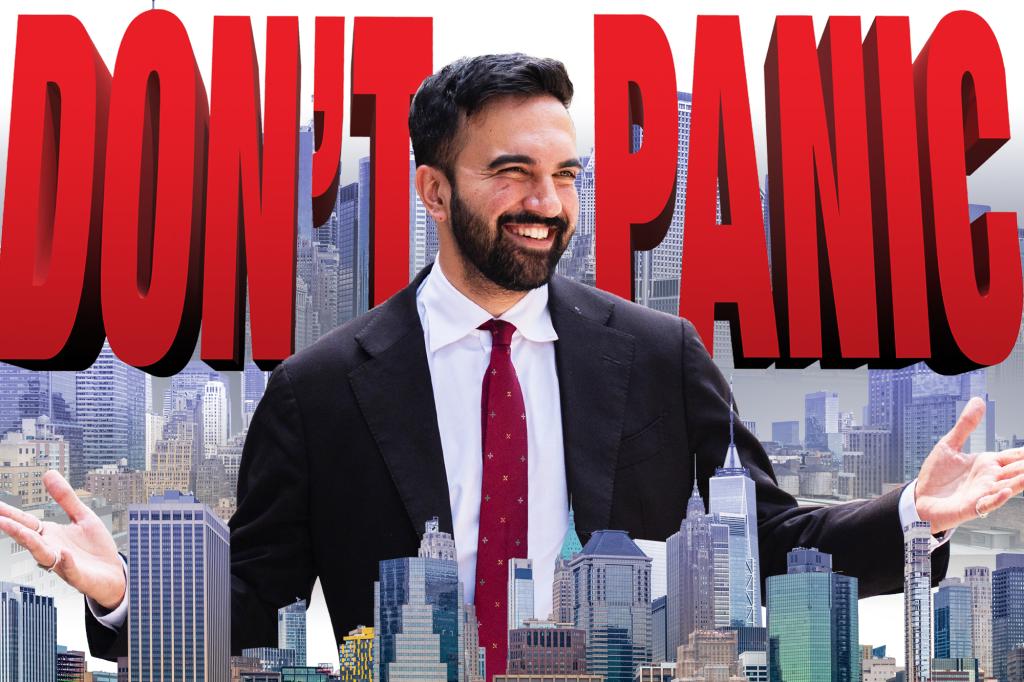

But there’s a good case to be made for playing an investment long game even if Zohran Mamdani becomes mayor.

Full disclosure: I hold NYC bonds, so I’ve done more than a little work on this issue. Muni’s — as they are known in the market – don’t get the respect they deserve from investment advisers because of the business media’s obsession with the stock market and the next hot tech company.

But they deserve your consideration: If you have a few bucks, they offer immense tax advantages. They are triple-tax free — free of city, state and federal taxes — when you buy a bond issued by the city or town where you live.

Given the high-taxes in New York City, and New York State, you can see why they’re a good deal. If you hold to the time they mature, you don’t have to worry about any adverse market moves. You just sit back and clip coupons. NYC muni returns seem a lot lower than stocks, but remember they’re not taxed.

Here’s where things can get dicey if you’re a muni holder. It’s rare but municipalities have been known to file for bankruptcy and screw bond holders. Puerto Rico did that not too long ago, same with Detroit and Orange County, Calif., back in the 1990s. NYC came close in the 1970s during the infamous financial crisis, but it avoided a full-on default.

The city’s budget under Eric Adams is pretty solid today for all Gotham’s problems. But remember defaults do occur when fiscal leaders spend more than they have.

Mamdani, if you take him at his word, wants to spend money like crazy and tax rich people and businesses so much that they will have little choice but to keep moving to Florida. It should be a recipe for default, and at least lower muni-bond prices following downgrades in ratings by bond-monitors like Fitch, S&P and Moody’s.

Bond holders, if he has his way, will be last to get paid and that’s if there’s any money left from his idiotic spending plans.

Fortunately for NYC muni buyers, it’s really not Mamdani’s call. There are two main types of NYC bonds – general obligations and something known as the Transitional Finance Authority (or TFA) debt, which was set up when the city hit its state-mandated limit to issue more debt so it could build infrastructure and keep the lights on.

Both have what’s known as “liens” or first dibs on tax revenues.

The GOs lien, created after the fiscal crisis to give people enough confidence to buy debt, is on property taxes. TFA gets first crack on personal income taxes and sales taxes before Mamdani might get his hands on the money.

This is all mandated by state law, not the city’s so it would take an act of the state Legislature to change the order of these payments, which is possible, though unlikely. The city and state need access to the market and messing with this would certainly prevent that.

Here’s where things could get interesting. If Mamdani becomes mayor, prices of NYC munis will fall because of his spending and because people and businesses will likely flee and those bond ratings will tank. Prices will dip since traders will bet there’s less money to go around.

But remember it pays to hold muni bonds to maturity and collect those coupons while you wait until you get your principal back at maturity. And in NYC, NYC muni holders get paid first. Given the high tax nature of the place, these bonds are often in demand, meaning you can make the case that Mamdani is a buying opportunity.

One potentially big caveat: There are a lot of Mamdanis in Albany, so it’s possible that Albany could undo all those bondholder protections down the road.

Either way if you already own NYC debt, now is not time to panic – even if a rank amateur takes up residence in Gracie Mansion.