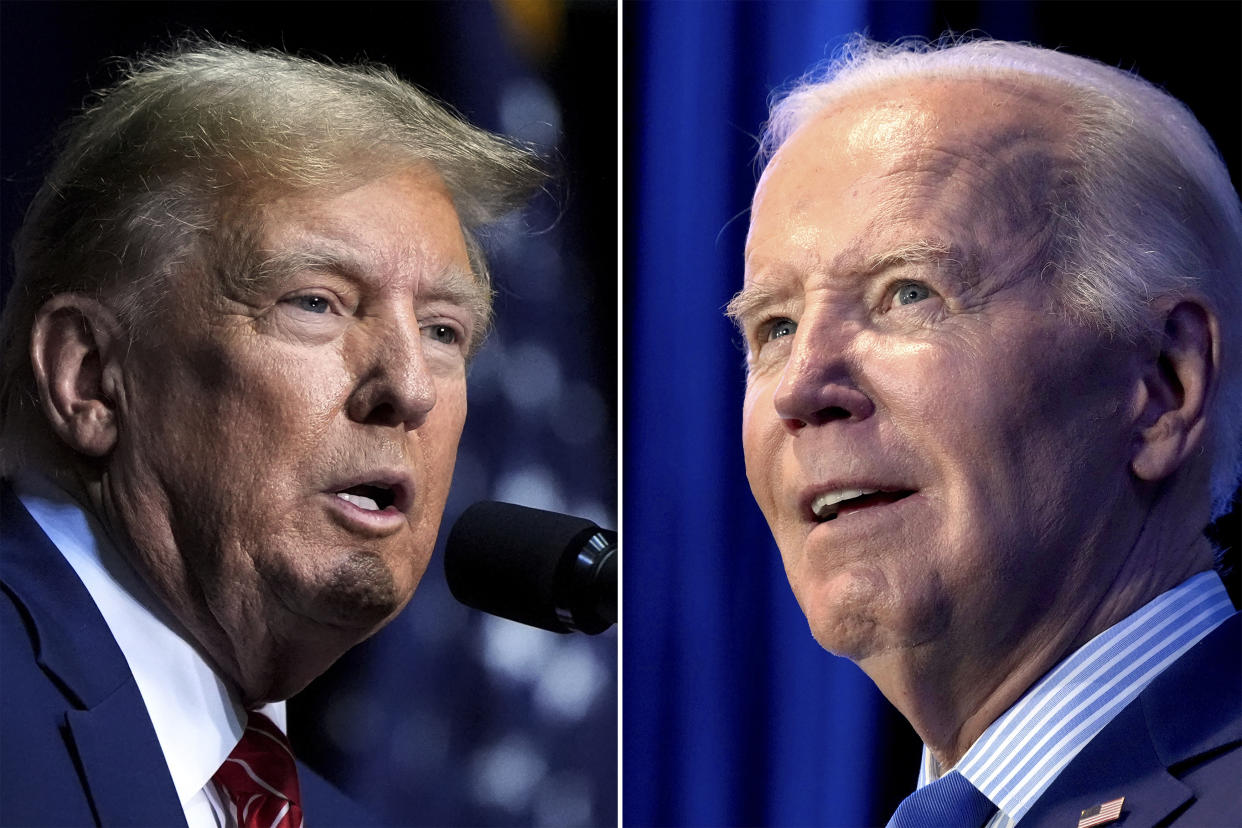

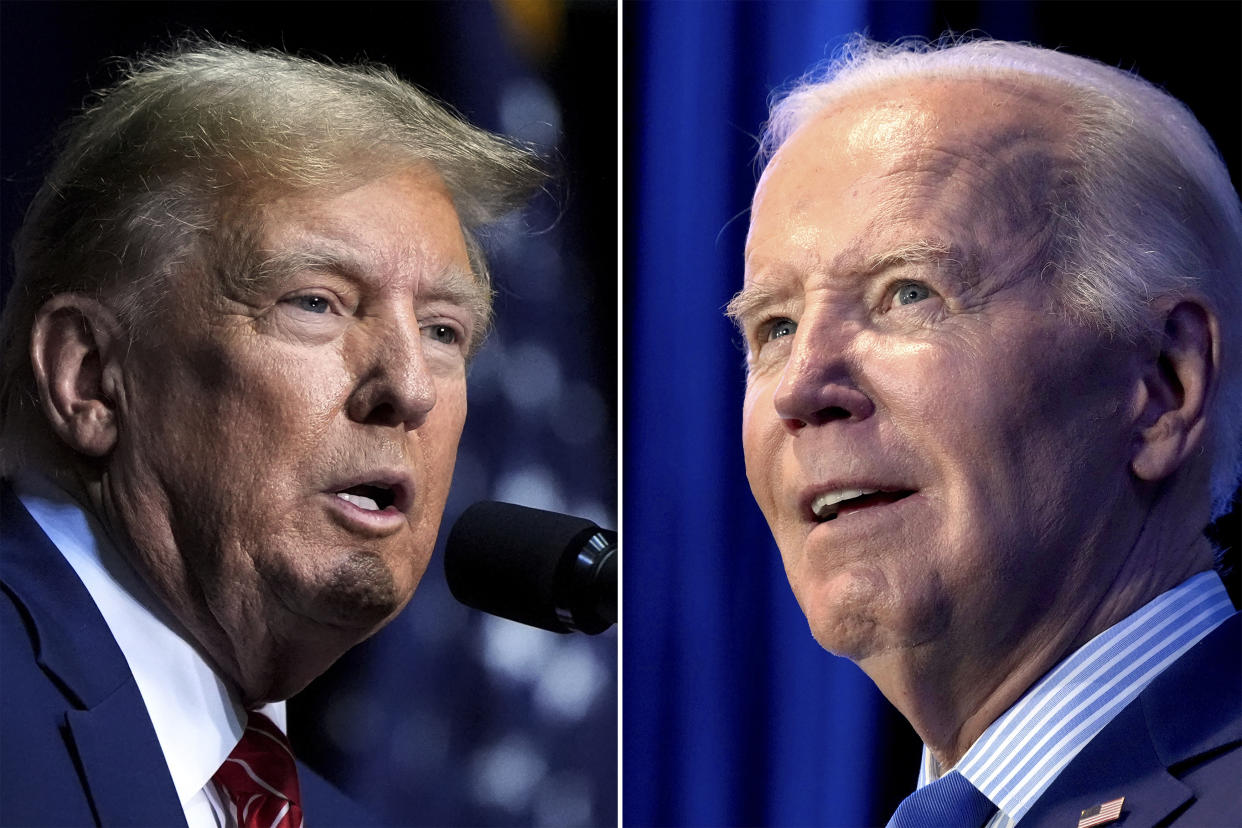

Trump Media & Technology Group (DJT) stock popped early on Friday before erasing gains and plummeting double digits after former President Donald Trump faced off against current commander in chief Joe Biden in the first presidential debate of 2024.

Shares of the parent company of Trump’s social media platform, Truth Social, fell about 12% in late afternoon trading.

Debate experts say Biden’s uneasy performance in the debate, which included a raspy voice and moments of confusion, could help Trump win come November. Biden’s age of 81 has been a hot-button topic among voters concerned over whether or not he can continue to run the country.

«Biden’s bumbling and stumbling performance amplified concerns regarding his capacity to serve and set off a new round of panic in the Democratic Party,» Isaac Boltansky, BTIG director of policy research, said in reaction to Thursday’s debate. «Trump won the debate and should be viewed as the clear frontrunner this morning, but his demeanor and falsehoods appeared to underscore the concerns some voters have with his fitness for office.»

Shares of DJT have been on a bumpy ride in recent months, oscillating between highs and lows.

In May, Trump was found guilty on all 34 counts of falsifying business records intended to influence the 2016 presidential campaign — a verdict that sent shares down 5% the day following the conviction.

Trump Media, the parent company of Truth Social, went public on the Nasdaq after merging with special purpose acquisition company Digital World Acquisition Corp.

Shares have fallen about 44% since the company’s public debut at the end of March.

Trump founded Truth Social after he was kicked off major social media apps like Facebook (META) and Twitter, the platform now known as X, following the Jan. 6 Capitol riots in 2021. Trump has since been reinstated on those platforms, although the former president almost exclusively posted on his Truth Social account throughout the trial.

In April, an updated regulatory filing showed Trump Media reported sales of just over $4 million as net losses reached nearly $60 million for the full year ending Dec. 31. The company warned it expects losses to continue amid greater profitability challenges.

In May, the company reported first quarter results that revealed losses of $327 million, mostly tied to expenses related to its SPAC deal. The company disclosed as of April 29 over 621,000 different shareholders owned stock in Trump Media, noting the «vast majority» of these were retail investors.

Trump maintains a roughly 60% stake in DJT. At current levels of around $32 a share, Trump Media boasts a market cap of roughly $4.3 billion, giving the former president a stake worth around $2.6 billion. Right after the company’s public debut, Trump’s stake was worth just over $4.5 billion.

In late April, the stock hit a milestone that secured Trump an additional $1.2 billion in cash. Stakeholders, however, are still subject to a six-month lockup period before selling or transferring shares.

Alexandra Canal is a Senior Reporter at Yahoo Finance. Follow her on X @allie_canal, LinkedIn, and email her at alexandra.canal@yahoofinance.com.

Read the latest financial and business news from Yahoo Finance